Fiscalisation Explained

Fiscalisation refers to configuring of fiscal devices to enable them to record and transmit sales and other tax information at the time of sale to the ZIMRA servers for use by the authority in Value Added Tax administration.

Who should fiscalise?

- All Value Added Tax (VAT) registered operators should fiscalise as outlined in SI 104 of 2010 and must comply with the requirements of ZIMRA’s Fiscalisation Data Management System (FDMS).

- All taxpayers are required to fiscalise in terms of Section 90 of the Income Tax Act [CAP 23:06] as read with Section 80D and Section 80DD of the same Act, which grants the Minister the authority to mandate fiscalisation through issued regulations. This obligation also applies to taxpayers with an annual turnover below the VAT registration threshold of USD 25,000.00.

What is Virtual Fiscalisation?

Virtual Fiscalisation is the use of software based Virtual Fiscal Devices (VFD) / Application Programming Interface (API) or software applications (POS) which are compatible with FDMS for recording, transmitting or interfacing with ZIMRA Servers. Virtual Fiscalisation options include:

- Direct Interface of Taxpayer Server –to- ZIMRA Server

- Direct Interface of taxpayer Accounting / POS System –to- ZIMRA Server

What are fiscal devices?

These are electronic devices that are used in the recording of transactional data before it is sent to the ZIMRA servers. The devices could be hardware based (physical devices) or software based (virtual devices). These are electronic devices which contain a “fiscal memory”. A “fiscal memory” is a special read only memory which is permanently built into a fiscalised device to store tax information at the time of the sale.

The following are broad categories of fiscal devices available in the market;

- Fiscalised electronic registers, also referred to as Cash Registers / Electronic Tax Registers (ETRs);

- Fiscalised Printers;

- Electronic Signature Devices (ESDs) and

- Virtual Fiscal Devices (VFD)

How do I know the type of device I am required to use?

VAT registered operators and other taxpayers not registered for VAT, are allowed to choose any fiscal devices they prefer, based on the nature of their business and their capacity to implement the chosen option. The fiscal devices are as listed above.

Here is a summary of the key benefits our virtual solution:

-

No device purchase/maintenance costs

-

No physical device certification fees

-

Avoid hardware obsolescence cycles

-

Automatic legal updates pushed to all users

-

No manual firmware upgrades required

-

Built-in audit trails meeting ZIMRA standards

-

No hardware failure risks

-

Disaster recovery protocols

-

24/7 system monitoring

-

Cloud access across multiple locations

-

Mobile-friendly tax reporting

-

Real-time updates across all users

-

Direct Accounting Software connection

-

Automated tax reporting workflows

-

AI-powered error detection

-

Live transaction dashboards

-

Predictive tax liability calculations

-

Automated reports sent regularly

-

Military-grade encryption (vs. physical device vulnerabilities)

-

Automated backups to secure servers

-

Bank-grade permission-based access controls

-

Add users/locations instantly

-

No hardware deployment delays

-

Pay-as-you-expand pricing

Common Questions & Answers

Virtual fiscalisation is a cloud-based system that replaces traditional hardware devices for tax compliance. It digitally records and encrypts sales transactions in real time, ensuring adherence to national/regional tax laws without physical hardware.

Yes. Our system complies with ZIMRA fiscal regulations and is certified by [list relevant authorities, e.g., “Germany’s BMF, Italy’s Agenzia delle Entrate”]. All transactions receive government-validated digital signatures.

Transactions are stored locally and auto-synced when connectivity resumes. All data remains encrypted and audit-proof, even offline.

Yes. We use:

– AES-256 encryption

– Regular penetration testing

– Role-based access controls

Absolutely. Our API supports seamless integration with several platforms, including but not limited to Quickbooks, Sage Pastel, Express Invoice and many more. If you dont have a system, we can provide you with one, or we can even fiscalise you on Excel.

Yes. We handle data migration and ensure continuity of compliance records.

Updates are automated and applied instantly to all users. You’ll never need manual upgrades or recertification.

Most businesses go live in <24-48 hours. No hardware shipping, installation, or certifications required.

Transparent pricing includes:

– No upfront hardware costs

– No maintenance fees

-No upgrades

– Pay only for active users/locations

Our interface mimics familiar POS workflows. Training takes <30 minutes, with 24/7 support

We are happy to have you on board. Please fill in this form and submit it online. You then need to make your payment to kickstart the process. We will get in touch with you to do the setup.

No data can be permanently deleted. All changes are tracked in an immutable audit trail for full transparency.

Guaranteed response times:

– Critical issues: <15 minutes

– General queries: <1 hour

– 98% resolution rate within 4 hours

– *Cost:* 60% lower TCO (no hardware/upgrades)

– *Speed:* Real-time compliance vs. batch updates

– *Scalability:* Add locations/users instantly

– *Security:* Bank-grade encryption vs. physical tampering risks

Provide inspectors with:

– Unique cryptographic transaction IDs

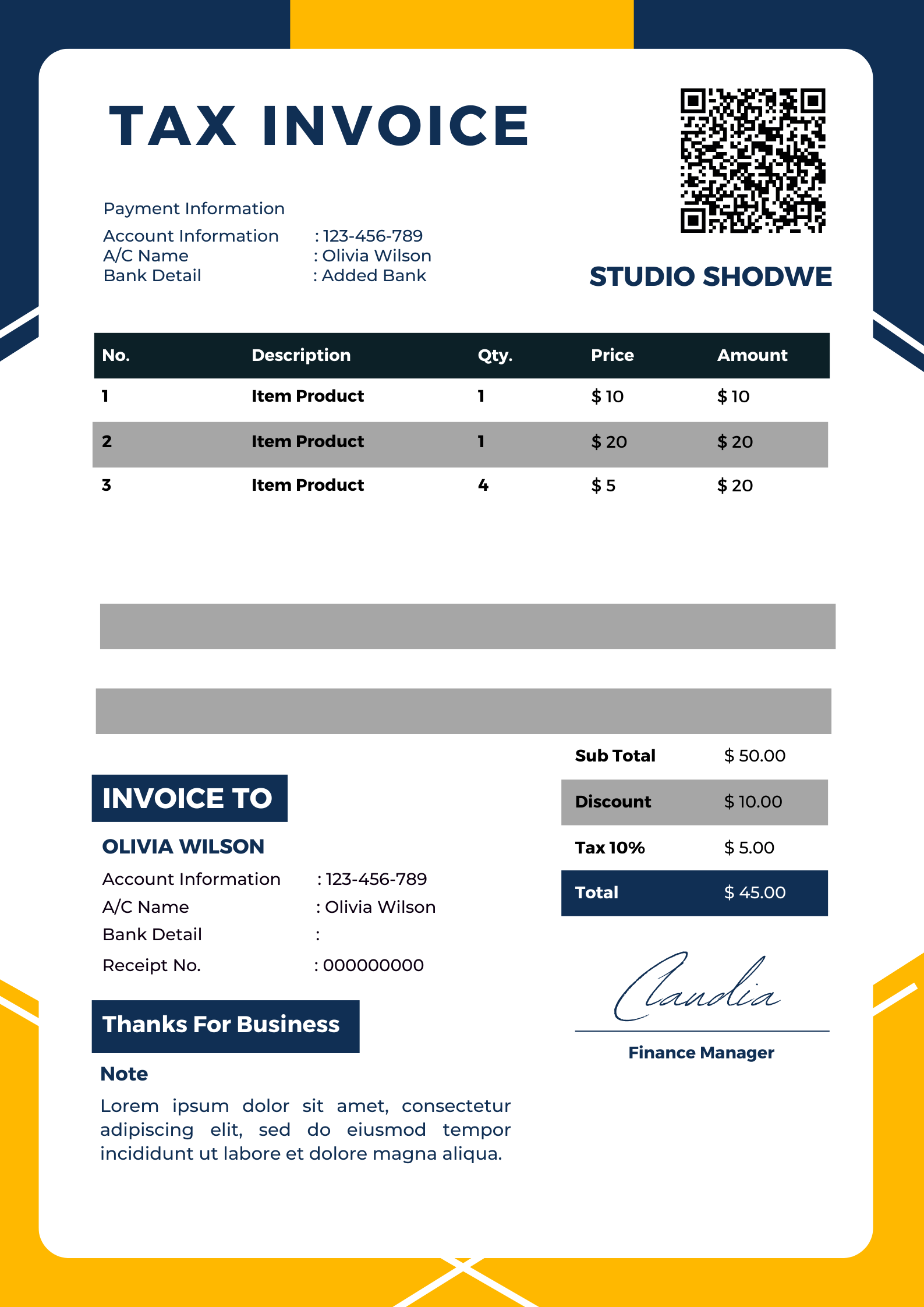

– QR-coded digital receipts

– Real-time access to your audit portal

Provide inspectors with:

– Unique cryptographic transaction IDs

– QR-coded digital receipts

– Real-time access to your audit portal