Compulsory VAT Registration

With effect from 1 January 2024 a trader is liable to register for VAT if the value of taxable supplies exceeds or is expected to exceed US$25,000.00 or ZiG equivalent within a period of 12 months. In cases where the operator has reached/exceeded a turnover of US$25,000.00 or ZiG equivalent but failed to register, the Commissioner General of the Zimbabwe Revenue Authority (ZIMRA) may compulsorily register the operator. The operator would be required to pay the VAT due, interest and penalties on the computed debt. Failure to register for VAT constitutes an offence in terms of the VAT Act (Chapter 23:12).

VAT Registration Requirements

- Must be registered with ZIMRA and have a TIN Number.

- Payments for all tax heads must be up to date.

- Sales Schedule from the time of commencement of trade to date.

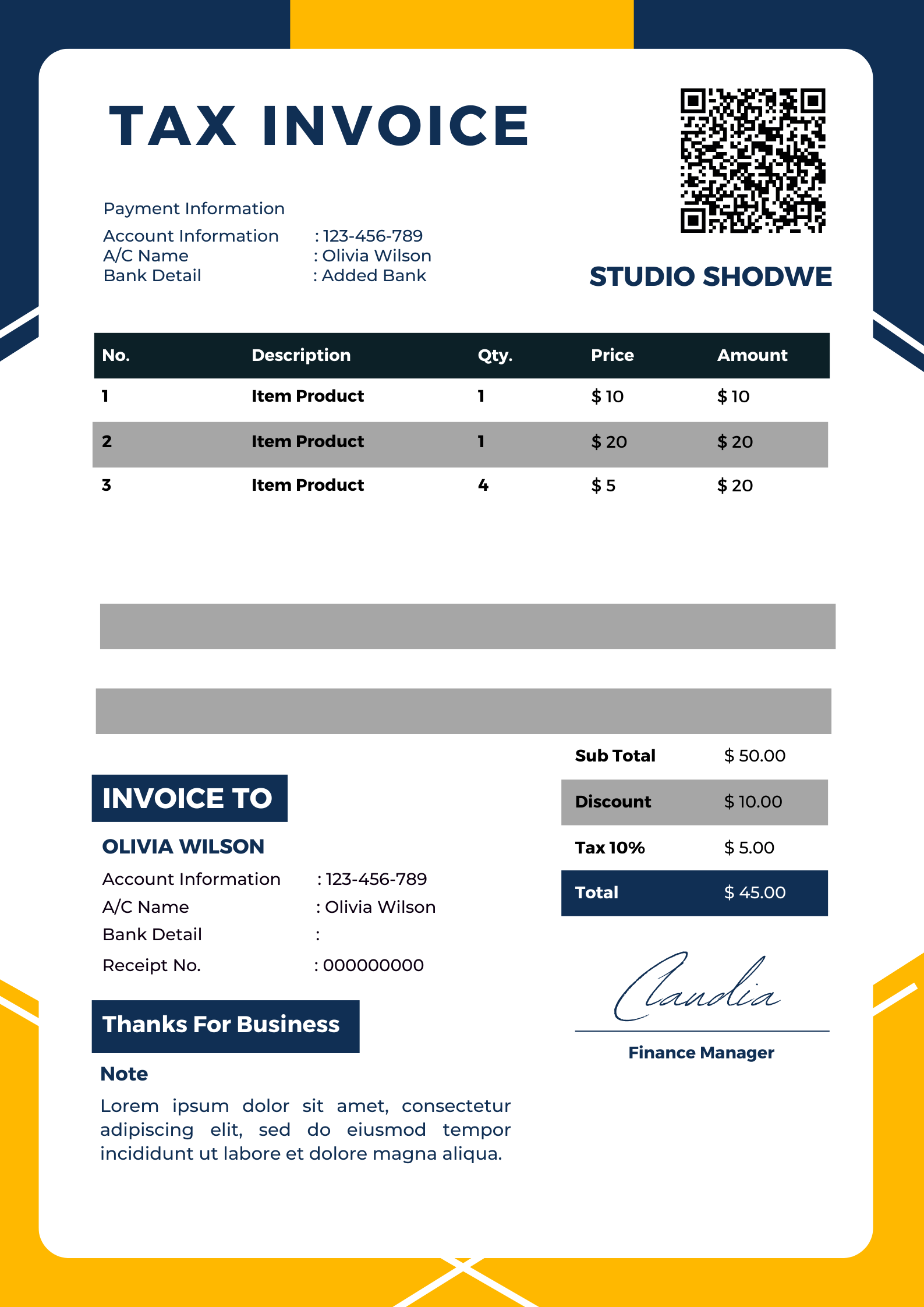

- A sample of sales invoices showing customers' name and telephone numbers

- Sales projections schedule for the next 12 months.

- Current stamped bank statement.

- Letter appointing public officer.

- Valid lease agreement in the company name

Who may be excluded from registration?

The following will not be obliged to register for VAT:

- Traders who will be solely dealing in exempt supplies;

- Any person conducting private or recreational pursuit or hobby;

- Any service provided by an employee to his employer or small traders whose taxable turnover is below US$25,000.00 or ZiG equivalent per annum

VAT Registration Common Questions

What is your typical project timeline and how do you ensure deadlines These titles are designed to capture the essence of your agency and make a strong first impression. are met Industry Solutions Start with a Simple Contact?

What is your typical project timeline and how do you ensure deadlines These titles are designed to capture the essence of your agency and make a strong first impression. are met Industry Solutions Start with a Simple Contact?

What is your typical project timeline and how do you ensure deadlines These titles are designed to capture the essence of your agency and make a strong first impression. are met Industry Solutions Start with a Simple Contact?

What is your typical project timeline and how do you ensure deadlines These titles are designed to capture the essence of your agency and make a strong first impression. are met Industry Solutions Start with a Simple Contact?

What is your typical project timeline and how do you ensure deadlines These titles are designed to capture the essence of your agency and make a strong first impression. are met Industry Solutions Start with a Simple Contact?

Book A Free IT Consultation

It is a long established fact that a reader will be distracted the readab content of a page when looking at layout the point.